Article Reader

Story: Shanti Prasad Tripathy Vs. Ajay Prasad Sharma

This is just a fictional story to explain the impact of withdrawing money during falling stock price. All characters are fictitious. Stock described in the story is closely based on a real stock data. This story has no intention to point out any specific issue with particular stock. The behavior of the stock in this story is generic and can be observed with most of the stocks at one point of time.

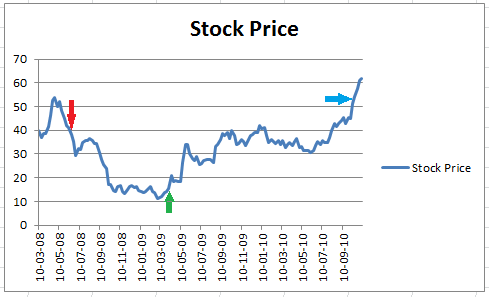

In 2008 two friends Lakshman Tripathy and Ajay Prasad Sharma decided to invest some money in equity market. They identified a stock at price Rs.40 and both of them bought 1000 stocks for Rs.40,000. Market was up and stock started moving upward till it reached Rs.54 and then started sliding down. Once it hit Rs.42 they reviewed their position. A.P.Sharma: "Stock has fallen by more than 20%. According to Rule-X I should get out of the position, so, I have decided to get out." Lakshman Tripathy: "I am a long term investor. I know the fundamental of this stock and management is sound. They are base of fashion garment industry. This stock is bound to bounce back. I'll continue the position." Mr. Sharma sold the stocks and put his Rs.42,000 in saving account. After around a year stock price slipped to Rs.11.30 and then first time rose to Rs.14/-. Mr.Sharma made a note of this event (more than 25% rise in price from the recent bottom. Rule-X). He decided to re-enter in the stock. He invested all his Rs.42,000 from previous transaction and bought 3000 stocks. After a year and half (total 2.5 year from first entry) stock price again reached Rs.54 and kept moving up. Following is the chart for the same.

Stock Price Movement. Red arrow is showing exit decision by APS, green for re-entry, and blue is matching point

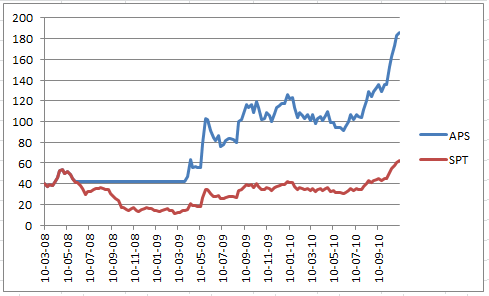

Lakshman Tripathy: "Ajay, see I was telling you this stock will bounce back and now it is back to Rs.54/-. Very soon it is going to hit Rs.100 and it will justify my investment." Mr. Tripathy is a long term investor. He is right. Whatever he predicted proved to be true and probably the stock will hit Rs.100/- soon. However, see the investment growth pattern of Ajay Prasad Sharma (Indeed he is following SMART rules and so equivalent to APS investors) during the same period. His net worth is more than 3 times that of Mr. Tripathy

Ajay investment has tripled of Lakshman

Conclusion:Prediction of stock or market is futile. Just be with the wave and outsmart the market

Do you have any query? Please write to us:

Did you like this article? Please share it with your social network